Quarterly Market Review April June 2021

The Markets (second quarter through June 30, 2021)

The second quarter began with stocks making solid gains in April. COVID vaccines became available to more Americans. The federal government and several states pushed forward with reopening after relaxing many of pandemic-related constraints. Economic data was favorable and encouraging. The first-quarter gross domestic product accelerated at an annualized rate of 6.4%, claims for unemployment slowed, 266,000 new jobs were added, and manufacturing expanded. Price inflation expanded, although the Federal Reserve asserted that it would continue stimulus measures, even if inflation reached and exceeded the Fed's 2.0% target. Each of the benchmark indexes listed here posted solid monthly gains, led by the Nasdaq (5.4%), followed by the S&P 500 (5.2%), the Global Dow (2.9%), the Dow (2.7%), and the Russell 2000 (2.1%). Bond prices increased, pulling yields lower. Crude oil prices ended April at $63.50 per barrel after increasing by more than 7.0% from March. The dollar slipped 2.1%, while gold prices rose 3.5%, closing April at $1,788.20 per troy ounce.

Stocks ended May with mixed returns, with the Global Dow (3.59%) and the Dow (1.93%) posting solid gains, while the Nasdaq fell 1.53%. Sector returns varied, with financials, energy, and materials gaining more than 3.0%, while consumer discretionary and information technology dipped more than 2.5%. Long-term Treasury yields decreased marginally, the dollar dropped 1.3%, while crude oil prices continued to climb, gaining nearly 5.0%. Overall, economic data was positive and confirmed that economic growth was accelerating, but not at the pace some may have anticipated. Labor added 266,000 new jobs, well below the nearly 1,000,000 figure some economists predicted. The number of job openings reached its highest level since 2000, which appears to point to a shortage of available workers rather than a slowdown in labor demand. Inflation was the buzzword throughout the month as consumer prices continued to climb, stoking fears that the Federal Reserve would cut back on stimulus measures in place. The personal consumption expenditures price index rose 0.6%, the Consumer Price Index climbed 0.8%, and producer prices increased 0.6%. Nevertheless, Fed officials repeated assurances that the price hikes were temporary due to "transitory supply chain bottlenecks."

Economic recovery continued in June. Stocks closed the month generally higher, with only the Dow and the Global Dow lagging. Tech shares rebounded from a moderate dip in May to push the Nasdaq to a series of record highs in June. Bond prices rose, dragging yields lower. Yields on 10-year Treasuries declined nearly 10 basis points last month. Crude oil prices climbed nearly $7.00 per barrel. Information technology led the sectors, advancing nearly 7.0%, while materials, financials, and consumer staples lost value. The dollar rose, while gold prices dropped. June saw 559,000 new jobs added, with notable job gains in leisure and hospitality, health care and social assistance, and manufacturing. Inflationary pressures may be peaking as supply-chain pressures that had driven commodity prices higher over the past several months may be easing. Lumber prices fell from record highs and retail vehicle prices may have crested as wholesale auto prices slid. Investor confidence may have been boosted in June with the announcement by President Joe Biden of a bipartisan infrastructure spending package.

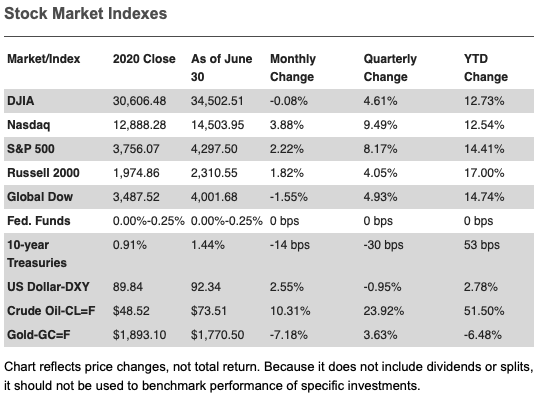

Overall, the second quarter was a good one for equities. The Nasdaq gained 9.5%, followed closely by the S&P 500 (8.2%), the Global Dow (4.9%), the Dow (4.6%), and the Russell 2000 (4.1%). Real estate, information technology, energy, and communication services all posted quarterly gains of more than 10.0% to lead the market sectors. Year to date, the Russell 2000 is well ahead of its 2020 year-end closing value, followed by the Global Dow, the S&P 500, the Dow, and the Nasdaq.

The yield on 10-year Treasuries fell 30 basis points. Crude oil prices increased $14.17 per barrel, or 24.0%, in the second quarter. The dollar lost nearly 1.0%, while gold prices advanced 3.6%. The national average retail price for regular gasoline was $3.091 per gallon on June 28, up from the May 31 price of $3.027 and 8.4% higher than the March 29 selling price of $2.852.

Last Month's Economic News

Employment: Job growth, while positive, is not meeting expectations. There were 559,000 new jobs added in May, below the level predicted by some economists (approximately 650,000). The April figure was revised up from 266,000 to 278,000 — still not quite as robust as had been estimated. Notable job growth in May occurred in leisure and hospitality (+292,000), in public and private education (+87,000), and in health care and social assistance (+45,800). In May, the unemployment rate declined 0.3 percentage point to 5.8%. In May, the number of unemployed persons fell by 496,000 to 9.3 million. These measures are down considerably from their recent highs in April 2020 but remain well above their levels prior to the pandemic (3.5% and 5.7 million, respectively, in February 2020). Among the unemployed, the number of persons on temporary layoff declined by 291,000 to 1.8 million. This measure is down considerably from the recent high of 18.0 million in April 2020 but is 1.1 million higher than in February 2020. In May, the number of persons not in the labor force who currently want a job was essentially unchanged at 6.6 million but is up by 1.6 million since February 2020. The number of employed persons who teleworked in May because of the pandemic fell to 16.6%, down from 18.3% in the prior month. In May, 7.9 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic. This measure is down from 9.4 million in April. In May, the labor force participation rate inched down 0.1 percentage point to 61.6%, and the employment-population ratio rose 0.1 percentage point to 58.0%. Average hourly earnings increased by $0.15 to $30.33 in May after increasing $0.21 in April. Average hourly earnings are up 2.0% from May 2020. In May, the average work week was 34.9 hours for the third month in a row.

Claims for unemployment insurance have maintained a fairly steady pace over the past few months. According to the latest weekly totals, as of June 12 there were 3,390,000 workers receiving unemployment insurance benefits, down marginally from the May 15 total of 3,642,000. The unemployment rate for the week ended June 12 was 2.4%, down 0.2 percentage point from the May 15 rate of 2.6%. During the week ended June 5, Extended Benefits were available in 12 states (14 states during the week of May 8); 51 states and territories reported 5,950,167 continued weekly claims for Pandemic Unemployment Assistance benefits (6,515,657 in May), and 51 states and territories reported 5,273,180 continued claims for Pandemic Emergency Unemployment Compensation benefits (5,191,642 in May).

FOMC/interest rates: The Federal Open Market Committee met in June. The FOMC offered no significant policy changes following that meeting, maintaining the federal funds target rate range at 0.00%-0.25%, while continuing the current quantitative easing monetary policies. There was a change in the Committee's quarterly projections, led by a projected increase in the federal funds rate in 2023. The FOMC continued to stress that current inflationary pressures are transitory and are likely to moderate.

GDP/budget: According to the third and final estimate, the economy accelerated at an annual rate of 6.4% in the first quarter of 2021 after advancing 4.3% in the fourth quarter of 2020. Consumer spending, as measured by personal consumption expenditures, increased 11.4% in the first quarter after rising 2.3% in the prior quarter. Nonresidential (business) fixed investment climbed 11.7% following a 13.1% increase in the fourth quarter; residential fixed investment continued to advance, increasing 13.1% in the first quarter after climbing 36.6% in the previous quarter. Exports decreased 2.9% in the first quarter of 2021 after advancing 22.3% in the fourth quarter of 2020, and imports (which are a negative in the calculation of GDP) increased 6.7% in the first quarter (29.8% in the fourth quarter of 2020). Federal nondefense government expenditures climbed 45.0% following a fourth-quarter decline of 8.9% primarily due to added federal stimulus payments and aid.

The Treasury budget deficit was $132.0 billion in May, following the April deficit of $225.6 billion. Government receipts were $463.7 billion in May ($439.2 billion in April), while outlays in May totaled $595.7 billion ($664.8 billion in April). The deficit is 67.0% lower than it was in May 2020. The deficit for the first eight months of fiscal year 2021, at $2.064 trillion, is 9.8% higher than the same period in the previous fiscal year. Government receipts rose from $2.019 trillion last fiscal year to $2.607 trillion this year, while government outlays increased from $3.899 trillion to $4.671 trillion.

Inflation/consumer spending: Inflationary pressures continued to advance in May. According to the latest Personal Income and Outlays report, consumer prices edged up 0.4% in May after advancing 0.6% in both March and April. Prices have increased 3.9% since May 2020. Excluding food and energy, consumer prices rose 0.5% in May (0.7% in April) and 3.4% since May 2020. Personal income decreased 0.2% in May after falling 13.1% in April. Disposable personal income dropped 2.3% in May following a 14.6% drop in April. The drop in personal income in May generally reflected a decrease in government assistance benefits, as both economic impact payments to households and pandemic unemployment compensation payments to individuals lessened. Consumer spending was essentially unchanged in May from the previous month.

The Consumer Price Index climbed 0.6% in May following a 0.8% increase in April. Over the 12 months ended in May, the CPI rose 5.0% — the largest 12-month increase since a 5.4% increase for the period ended in August 2008. Core prices, excluding food and energy, advanced 0.7% in May and are up 3.8% over the last 12 months. Prices for used cars and trucks continued to rise sharply, increasing 7.3% in May. This increase accounted for about one-third of the overall CPI increase. Food prices increased 0.4% in May, the same increase as in April. Energy prices were unchanged in May.

Prices that producers receive for goods and services continued to climb in May, increasing 0.8% after advancing 0.6% in April. Producer prices increased 6.6% for the 12 months ended in May, the largest yearly gain since November 2010 when 12-month data was first calculated. Producer prices less foods, energy, and trade services rose for the thirteenth consecutive month after advancing 0.7% in May. Food prices rose 2.6% and energy prices increased 2.2% in May.

Housing: Over the past several months, residential sales have slowed. In May, sales of existing homes fell for the fourth consecutive month, declining 0.9% after decreasing 2.7% in April. Nevertheless, over the past 12 months, existing home sales increased 44.6%. The median existing-home price was $350,300 in May ($341,600 in April), up 23.6% from May 2020. Unsold inventory of existing homes represented a 2.5-month supply in May, slightly higher than the 2.4-month supply in April. Sales of existing single-family homes decreased 1.0% in May following a 3.2% drop in April. Year over year, sales of existing single-family homes rose 24.4%. The median existing single-family home price was $356,600 in May, up from $347,400 in April.

New single-family home sales declined in May for the second consecutive month. New home sales fell 5.9% in May, the same decrease as in April. Sales of new single-family homes have increased 9.2% from May 2020. The median sales price of new single-family houses sold in May was $374,400 ($372,400 in April). The May average sales price was $430,600 ($435,400 in April). The inventory of new single-family homes for sale in May represents a supply of 5.1 months at the current sales pace, up from the April estimate of 4.4 months.

Manufacturing: Industrial production increased 0.8% in May after advancing 0.7% the previous month. Manufacturing output increased 0.9% in May following a 0.4% increase in April. In May, mining increased 1.2% (0.7% in April) and utilities rose 0.2% (2.6% in April). Total industrial production in May was 16.3% higher than its year-earlier level, but it was 1.4% below its pre-pandemic (February 2020) level.

New orders for durable goods increased 2.3% in May after falling 0.8% in April. Transportation equipment, up following two consecutive monthly decreases, led the increase, climbing 7.6% in May. Excluding transportation, new orders increased 0.3% in May. Excluding defense, new orders rose 1.7%. New orders for capital goods advanced 4.2% in May following a 0.8% increase in April. New orders for nondefense capital goods increased 2.7% in May, while new orders for defense capital goods rose 17.4%.

Imports and exports: Both import and export prices rose in May for the sixth consecutive month. Import prices climbed 1.1% following a 0.8% advance in April. Import prices rose 11.3% over the 12 months ended in May, the largest 12-month advance since a 12.7% increase for the 12 months ended in September 2011. Import fuel prices increased 4.0% in May following a 1.6% jump in April. Import fuel prices advanced 109.6% for the year ended in May. Nonfuel import prices climbed 0.9% in May following a 0.7% advance in April. Export prices increased 2.2% in May after climbing 1.1% in April. For the year ended in May, the price index for exports rose 17.4%, the largest 12-month increase since the index was first published in September 1983. Agricultural export prices increased 6.1% in May following a 0.6% advance in April. Nonagricultural exports rose 1.7% in May after increasing 1.2% in April.

The international trade in goods deficit was $88.1 billion in May, up $2.4 billion, or 2.8%, from April. Exports dipped 0.3%, while imports rose 0.8%. For the 12 months ended in May, exports have risen 58.6%, while imports have increased 39.2%.

The latest information on international trade in goods and services, out June 8, is for April and shows that the goods and services trade deficit was $68.9 billion, 8.2% lower than the March deficit. April exports were $205.0 billion, or 1.1%, greater than March exports. April imports were $273.9 billion, or 1.4%, lower than March imports. Year over year, the goods and services deficit increased $94.5 billion, or 50.5%, from April 2020. Exports increased $42.0 billion, or 5.6%. Imports increased $136.4 billion, or 14.6%.

International markets: While the Federal Reserve continues to preach patience when it comes to rising inflationary pressures, other countries may not be waiting to respond. The Bank of Mexico increased its interbank rate 25 basis points to 4.25%, citing the jump in the U.S. Consumer Price Index. On the other hand, the Bank of England held its monetary policy stance unchanged, with the bank rate at 0.1%. Elsewhere, the Eurozone continued to reopen its economy, but at a slower pace than in the United States primarily due to the slower start of COVID-19 vaccinations. Eurozone manufacturing expanded in June. The IHS Markit Eurozone Composite PMI® increased from 57.1 in May to 59.2 in June. The Japanese economy has taken longer to recover. The au Jibun Bank Flash Japan Composite PMI® dropped 1.1 percentage point in June to 47.8, which remains in contraction territory. In the markets for June, the STOXX Europe 600 Index gained about 2.3%; the United Kingdom's FTSE rose 1.1%; Japan's Nikkei 225 index fell 0.2%; and China's Shanghai Composite Index declined nearly 1.2%.

Consumer confidence: According to the latest report from the Conference Board, consumer confidence improved in June. The Consumer Confidence Index® advanced 7.3 percentage points in June to 127.3. The Present Situation Index, based on consumers' assessment of current business and labor market conditions, increased from 148.7.9 in May to 157.7 in June. The Expectations Index, based on consumers' short-term outlook for income, business, and labor market conditions, rose to 107.0 in June from May's 100.9. According to the report, following June's increase, consumer confidence is at its highest level since the onset of the pandemic in March 2020. Despite consumers' expectations that short-term inflation will increase, this had little impact on consumers' confidence or purchasing intentions.

Eye on the Month Ahead

Economic data for the second quarter in general, and for June in particular, was generally positive. Heading into the third quarter of the year, the first estimate of the second-quarter gross domestic product is available in July. The economy accelerated at an annualized rate of 6.4% in the first quarter. Employment data for June is also out this month. May saw 559,000 new jobs added and the unemployment rate dip to 5.8%.

Key Dates/Data Releases

7/1: Markit PMI Manufacturing Index

7/2: Employment situation, international trade in goods and services

7/6: Markit PMI Services Index

7/7: JOLTS

7/13: Consumer Price Index, Treasury budget

7/14: Producer Price Index

7/15: Import and export prices, industrial production

7/16: Retail sales

7/20: Housing starts

7/22: Existing home sales

7/26: New home sales

7/27: Durable goods orders

7/28: FOMC statement, international trade in goods

7/29: GDP

7/30: Personal income and outlays

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indices listed are unmanaged and are not available for direct investment.

Prepared by Broadridge Advisor Solutions Copyright 2021.