What Do We Do Now

The Wealth Management team at TrustBank is committed to actively monitoring the markets and how they affect your individual portfolios. Given the recent market volatility, we felt it was a good time to reach out and share our thoughts on the current market environment.

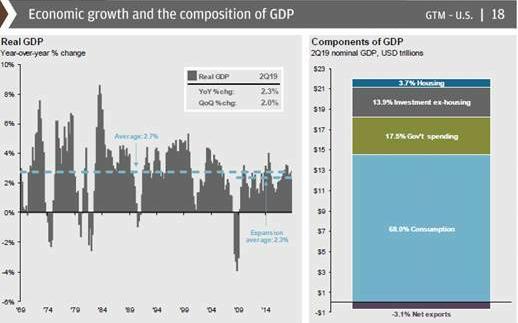

Despite the Worry – No signs of recession in the U.S. at the present time.

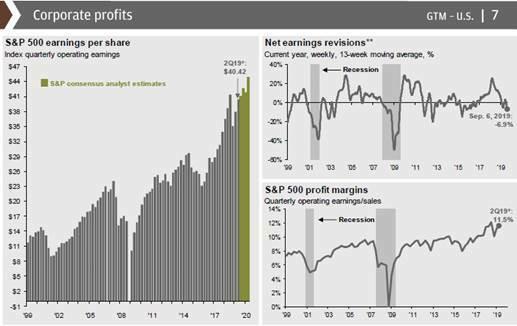

Despite the Trade Tariffs – Corporate profits in aggregate are still strong and profit margins remain near historic highs. We do acknowledge that some companies are now revising their forward earnings down.

(Source: JP Morgan Asset Management, September 2019)

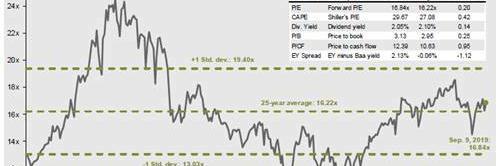

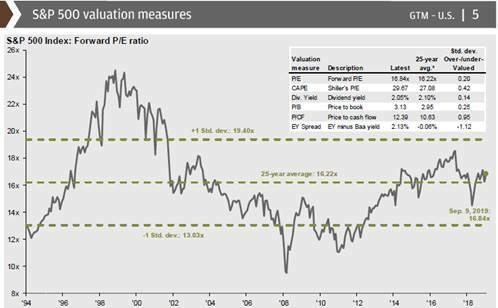

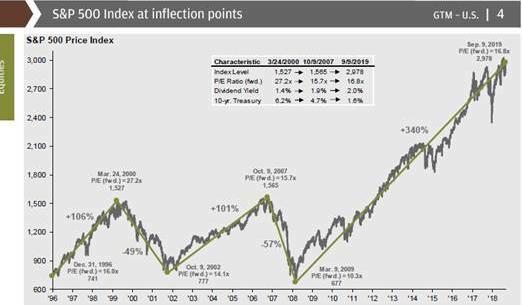

Despite All the Talk of a Coming Bear Market - The S&P 500 has climbed the proverbial Wall of Worry and remains near its all-time high. Price-to-Earnings valuations while elevated, are not extreme.

(Source: JP Morgan Asset Management, September 2019)

(Source: JP Morgan Asset Management, September 2019)

So back to our question - What Do We Do Now?

- We continue to take a long-term view in managing your investments while acknowledging that short-term market volatility can be a source of stress for our clients.

- In the interest of reducing risk, we may begin modestly trimming our equity allocation over the next several weeks.

- As we enter the late stages of a 10+ year bull market, we believe it is prudent to take profits, albeit on a case by case basis, and rebalance our portfolios accordingly

- We will continue to communicate with our clients and be accessible should you have any questions or concerns.

As always, please reach out to the team with any questions regarding your personal investment plan.