Going Green: A Fast‑Growing Corner of the Global Bond Market

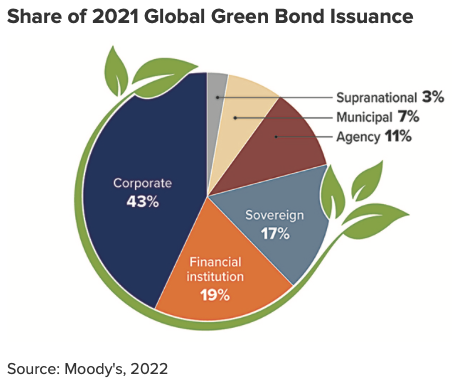

Green bonds are debt instruments that corporations and governments can use exclusively to finance major climate-related or eco-friendly initiatives. Global issuance of green bonds reached a record $523 billion in 2021, and is expected to exceed $775 billion in 2022.1

The growth in green bonds is closely tied to a broader investment trend that gained traction in recent years: Investors have increasingly considered environmental, social, and governance (ESG) principles in their efforts to address the world's problems and help reduce the related portfolio risks.

Prioritizing the Planet

Some common types of projects funded by green bonds include transitioning to renewable energy, modernizing the electric grid, ensuring sustainable water supplies, and building clean transportation systems. Issuers must typically provide investors with certain information, such as a detailed outline of the project they plan to fund, estimates of the environmental impact, and regular progress reports. The European Union and a growing number of sovereign nations have issued green bonds. The U.S. government has not sold green bonds, but mortgage giant Fannie Mae, some states and municipalities, and well-known U.S. corporations have issued them.2

Like all bonds, green bonds are rated for credit risk. A range of AAA down to BBB (or Baa) is considered "investment grade," and lower-rated or "junk" bonds carry greater risk.

Investors who take on more risk are generally compensated with higher interest rates. Because government entities have the power to raise taxes and fees as needed to pay the interest, municipal bonds are generally considered less risky than corporate bonds, so they typically offer lower interest rates.

Bond prices and interest rates are also influenced by supply and demand. In some cases, enthusiastic investor demand for green bonds has driven up prices and pushed down yields, resulting in a small cost savings (0.1 to 0.2 percentage point) for the issuers. This also suggests that the buyers were willing to pay a slight premium (or "greenium") for bonds that are intended to fund a greener future.3

Evolving Standards

The term "greenwashing" describes the concern that some companies might try to attract eco-conscious investors with misleading claims. Corporations don't always report sufficient ESG data, and currently there is no standardized criteria by which to judge sustainability-related risks and investment opportunities. However, investors may soon have access to more reliable information. The International Sustainability Standards Board has been tasked with setting global standards that may provide a baseline for ESG disclosure.4 U.S. regulators at the Securities and Exchange Commission are expected to propose new climate-risk disclosure rules.5

Some corporate bond issuers enlist third parties to provide verification that their green bonds would indeed finance projects intended to have a positive environmental impact. Still, investors may want to look beyond a bond investment's green label and take a deeper dive into the specific projects being funded, as well as the issuer's finances and overall environmental record.

The principal value of all bonds tends to fluctuate with changes in market conditions. As interest rates rise, bond prices typically fall, and vice versa. Bonds redeemed prior to maturity may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve a higher degree of risk. In addition to credit and interest-rate risks, the risks associated with purchasing bonds from other countries include differences in financial reporting, currency exchange risk, as well as economic and political risks unique to a specific country. This may result in greater price volatility.

Interest paid by municipal bonds issued by the owner's state or local government is typically free of federal income tax. If a bond was issued by a municipality outside the home state, the interest could be subject to state and local income taxes. A municipal bond sold at a profit could incur capital gains taxes. Some municipal bond interest could be subject to the [federal and state] alternative minimum tax.

1) Moody's, January 31, 2022

2) World Economic Forum, October 26, 2021

3) The Wall Street Journal, December 17, 2020

4) S&P Global, October 15, 2021

5) Bloomberg, September 15, 2021

Prepared by Broadridge Advisor Solutions Copyright 2022.